The Dry Powder Ratio

A New Metric to Measure the Fragility of the Startup Ecosystem

Note: this essay was previously published in September 2022

It has been ten months since the Nasdaq reached its prior peak, seven months since Vladimir Putin invaded Ukraine, and one month since the U.S. formally entered a recession after two quarters of negative GDP growth. Much has already been written about the market downturn and its impact on the startup ecosystem. Founders are taking steps to extend cash runway, and investors have slowed their pace of deployment. In times of uncertainty, the name of the game is survival.

This post takes a step back and attempts to answer the following question:

How fragile is the startup ecosystem exactly?

Part of the answer is rooted in a fundamental misunderstanding that is currently accepted as fact. This misunderstanding relates to dry powder – its definition, size, and implications. By defining a new metric, the Dry Powder Ratio, we can recast a misunderstood term to help us measure the fragility of our industry.

Defining Dry Powder

In venture capital, dry powder refers to the amount of committed, but unallocated, capital available to a firm. These are the funds a VC firm has raised from its limited partners but not yet deployed into startups.

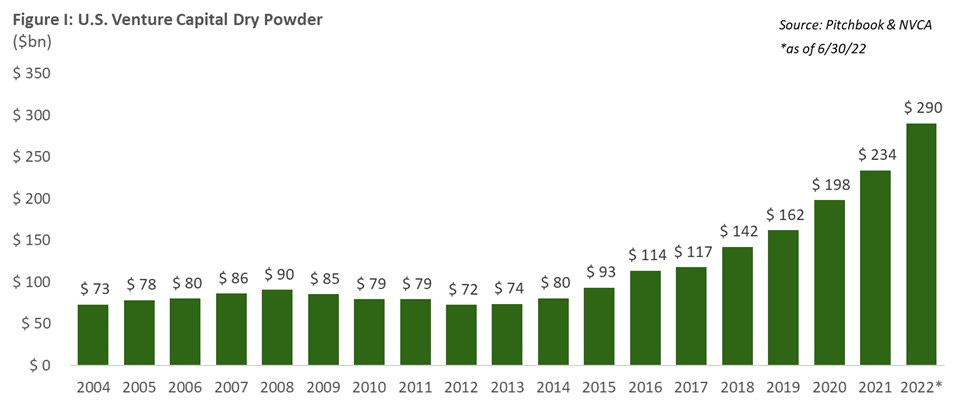

During bull runs, companies are marked at higher valuations, fund returns look increasingly attractive, and limited partners desire more exposure to startups and growth companies. As we can see in Figure I below, these dynamics cause dry powder to explode.

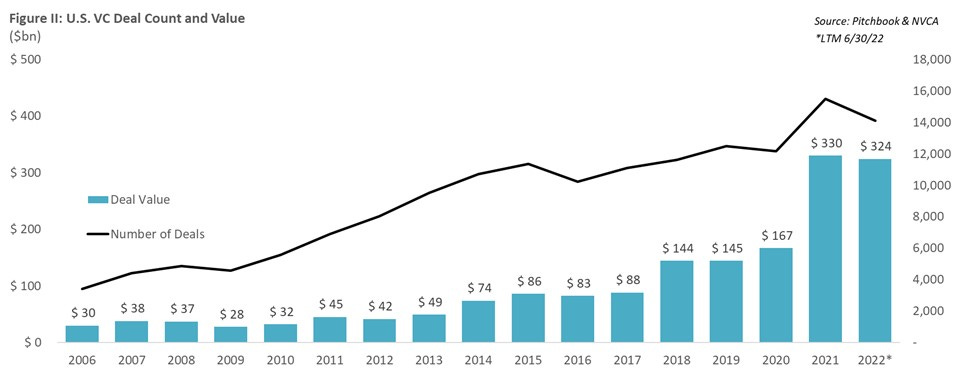

Today, VC funds are sitting on a record haul of $290bn, more than double the amount of dry powder from five years ago and almost three times the ~$100bn of dry powder that existed at the peak of the Dot-Com Bubble. Of course, dry powder does not grow unchecked. As new funds are raised, capital is also deployed, and deal velocity (both size and frequency of deals) follows a similar trajectory.

Dry Powder and Downturns

So what role does dry powder play during a downturn?

Downturns affect different parts of the market differently. In the startup ecosystem, the impact of recession is real, but can also be relatively muted. Sure – valuations decline, fundraising activity shrinks, exit opportunities dry up, and maybe selling a product or service becomes more challenging. Despite these consequences, however, startups also have two things going for them:

The cash on their balance sheet

The cash sitting in VC funds

The former is runway, and it allows cash flow negative startups to continue operations for a finite period. The latter is dry powder, and it allows startups to tap into additional pools of capital to prevent shutting down. With the extra time, startups can figure out ways to adjust strategy, boost revenues, and improve margins.

This is why dry powder is so important. The more dry powder that exists, the more protection startups have from failing. VCs can continue to back their portfolio companies, or they can invest in companies in other VC portfolios, or they can invest in brand new companies. The point is…even during a recession, VCs still have money to invest, even when money has become scarce everywhere else.

The Dry Powder Ratio

As an investor, it’s easy to look back at Figure I and conclude, “There’s $290bn of dry powder in the U.S. venture capital market! My portfolio companies should be able to raise money and weather the storm!” In fact, this sentiment is fairly widespread – see here, here, here, here, here, and here.

Unfortunately, nominal dry powder is not the correct metric to measure whether markets are well-capitalized.

The correct metric is the amount of dry powder relative to the amount of capital existing startups need to raise to fund operations. The latter is quite difficult to measure – it’s a function of the cash burn and cash runway of all U.S. startups. As a proxy, however, we can use the total amount of venture investment each year. Let’s call this the Dry Powder Ratio.

Dry Powder Ratio = Dry Powder / Total Annual U.S. VC Investment

The Dry Powder Ratio represents the number of years of capital reserves given the current investment pace. Whereas nominal dry powder demonstrates the total dollars VCs need to deploy, the Dry Powder Ratio estimates how quickly those dollars will be deployed. When the ratio is high, the ecosystem is flush with capital. When the ratio is low, venture funds must continue raising money to support existing and new investments.

Analyzing the Dry Powder Ratio

There is no magic threshold for what the Dry Powder Ratio should or should not be. Instead, the Dry Powder Ratio illustrates where we are today relative to prior periods.

As is evident in Figure III, the amount of dry powder relative to annual deal value has significantly contracted in the last two decades. Looking even further back, the current Dry Powder Ratio of sub-1.0x stand in stark contrast against the 1981 – 2001 average of 2.3x as well as the prior trough at the height of the Dot-Com Bubble.

The decline in the Dry Powder Ratio represents an unprecedented shift in the U.S. startup ecosystem. If the capital needs of startups remain constant, the $290bn surplus of dry powder will not last longer than a year. In other words, U.S. VC funds are more reliant on new capital entering the system than ever before.

Of course, the capital needs of startups do not remain constant. This is why, for example, founders are being advised to cuts costs and extend runway. Furthermore, it’s possible that average startup runway is longer today than during prior downturns, due to the sheer amount of capital that was raised by companies prior to the downturn.

However, while there are a few caveats to the recent trends in the Dry Powder Ratio, those caveats are likely limited in scope. First, extending runway is not something that can be completed overnight. The overwhelming majority of startups are cash flow negative (even in the years preceding and following IPO), so being conservative with cash can only take you so far, especially if your company already has little cash in the bank or your business model has unprofitable or unscalable unit economics. And second, for many companies, costs have scaled with the cash they’ve raised, resulting in negligible impact to runway.

It should also be noted that there is another way in which startups, in aggregate, become less dependent on cash. Companies fail. The math is simple – when there are less companies to invest in, less cash is needed to support those companies. This dynamic played out during the Dot-Com Bubble and was one of the driving factors for the rebound in the Dry Powder Ratio within a few years following the crash.

We do not know how severe the current downturn will be. We do not even know to what extent VC firms will struggle to raise new funds. Nonetheless, the Dry Powder Ratio indicates that we have entered the current downturn with a limited amount of cash, and the notion that existing dry powder will provide a meaningful buffer to startups is misleading at best.

Other Considerations

The Dry Powder Ratio varies fund-by-fund: Funds have dry powder on an individual basis and can calculate a fund-specific Dry Powder Ratio (a fund’s dry powder divided by the capital needed to sustain their portfolio). By design, most VC funds will not be able to support their entire portfolio without the help of other investors; however, having a high fund-specific Dry Powder Ratio provides greater flexibility to managers and the founders they have chosen to back. Furthermore, founders can estimate the quality of their investors’ dry powder by comparing their cash needs to the amount of undeployed capital in their VC’s funds.

Excess dry powder carries its own risks: Most VC funds have a lifecycle, typically ten years, in which to invest their capital and then return profits. Excess dry powder, particularly in bull markets, places managers in a difficult position where too much money is chasing too few deals, which drives unreasonable valuations. Ironically, unhealthy excess dry powder can create the precise bear market conditions where dry powder then becomes desirable.

In extreme downturns, existing dry powder is often overstated due to LP defaults: LP defaults – when limited partners are unable, or unwilling, to meet their capital commitment obligations – are very rare. However, when there are significant shocks to the economy, the rate of LP default increases, and the estimated amount of Dry Powder does not fully materialize.

Conclusion

The Dry Powder Ratio, at a historic low, demonstrates that current dry powder levels may not be enough to support U.S. startups if VC firms struggle to raise new funds.

Of course, there is no substitute for a good business model. Efficiently run companies that sell useful products should continue to raise capital. Companies lacking those characteristics will fail in the long run, regardless of how much dry powder exists in the system. And yet, it takes time to become an efficiently run company with a good product. For some startups, that time is short, and for other startups, that time is lengthy with many bumps along the way. The Dry Powder Ratio is a proxy for the fragility of the startup ecosystem insofar as it is a proxy for time. Not all companies that fail during a downturn would have otherwise. This is why the Dry Powder Ratio matters.